Tax rebate overshadows sector-specific Budget initiatives

In a Budget literally saved by the rollback of pay equity provisions that cut over $12 billion in future costs for the Government, there was little in the kitty for new digital and tech-related initiatives.

But the Government’s new investment Boost tax incentive, which allows businesses to immediately deduct 20% of the cost of a new asset, on top of depreciation, in the year of purchase, will make a different for tech companies.

“The Treasury and Inland Revenue estimate Investment Boost will improve economic growth, lifting New Zealand’s GDP by 1 per cent, wages by 1.5% and our capital stock by 1.6% over the next 20 years, with around half these gains expected in the first five years,” Finance Minister Nicola Willis noted in a press release today.

That’s not to be sniffed at. There’s no cap on the value of eligible investments and all businesses, regardless of size, can benefit. For instance, via Investment Boost, “an advanced manufacturing firm that purchases a $200,000 environmental test chamber would reduce its tax bill by more than $10,000 in the year of purchase,” the Government pointed out.

That will equally go for games developers, robotics firms, and agritech companies.

“To achieve that growth, New Zealand needs businesses to invest in productive assets – like machinery, tools, equipment, vehicles and technology. Investment drives productivity improvements, makes firms more competitive and supports employers to improve workers’ wages,” Willis reminded.

The policy is expected to cost an average of $1.7 billion per year in reduced revenue across the forecast period, so over $6 billion all up. All the figures listed are from Budget 2025 - Summary of Initiatives.

Tech and innovation-related spending - shifting priorities, research cuts, little new cash

Most of the spending in these areas is reprioritised spending, with the wind down of Callaghan Innovation freeing up funds to spend elsewhere. The Government has put aside a total of $38.1 million in new cash from 2024 - 2026 for disestablishing the innovation agency, including redundancies, chemical removal and IT-decommissioning costs.

Related to that is a $20 million provision allocated to the Government Innovation Quarter (GIQ) at Gracefield, Lower Hutt, to keep operating “until the Government decides about its future involvement in GIQ”.

There’s $22.9 million over four years to establish a gene tech regulator to liberalise genetic modification regulations and operate the new regime. The legislation underpinning it is expected to be passed later this year.

The recently announced and frankly tech-lite Prime Minister’s Science, Innovation and Technology Advisory Council gets $5.8 million over four years.

Invest New Zealand gets $84.6 million over four years largely reprioritised from Callaghan Innovation funding and will have “a particular interest in investing in science, innovation and technology to drive economic growth,” attempting to attract foreign investment into those areas as Ireland and Singapore have been so successful in doing.

There’s $20.7 million for Science, Innovation and Technology Policy Advice Capability, which once again, is reprioritised. And there’s $212.1 million put aside for the science and tech sector reforms, money that has been taken from Health Research, Marsden, Partnered Research, and Strategic Science Investment funds, the Innovation Trailblazer and New to R&D grants, disestablished Callaghan Innovation functions, and the transfer of investment attraction functions from New Zealand Trade and Enterprise”.

$20 million will be allocated to establishing the Bioeconomy, Earth Sciences and Health and Forensic Public Research Organisations over th next two years.

Where does that leave the science and innovation sector?

“Overall, science funding has dropped by approximately $45 million,” Dr Lucy Stewart, Co-President, New Zealand Association of Scientists, told the Science Media Centre.

The Health Research Fund, the Catalyst Fund, and other funds are being cut to pay for the set-up of the new Public Research Organisations and a new gene technology regulator. The Endeavour Fund is relatively untouched, but we know that no new grants will be made in 2026 – so for researchers who aren’t successful in the current funding round, this funding will still be unobtainable. Significant cuts are also forecast in future years for the Marsden Fund and the Strategic Science Investment Fund.”

Elevate Fund boost

As previously announced, there’s $100 million in new funding for the Government’s Elevate fund for investing in Kiwi startups in conjunction with venture capital firms. That was widely requested by the tech sector, but really is a drop in the bucket in terms of fresh capital.

Defence spend-up has tech elements

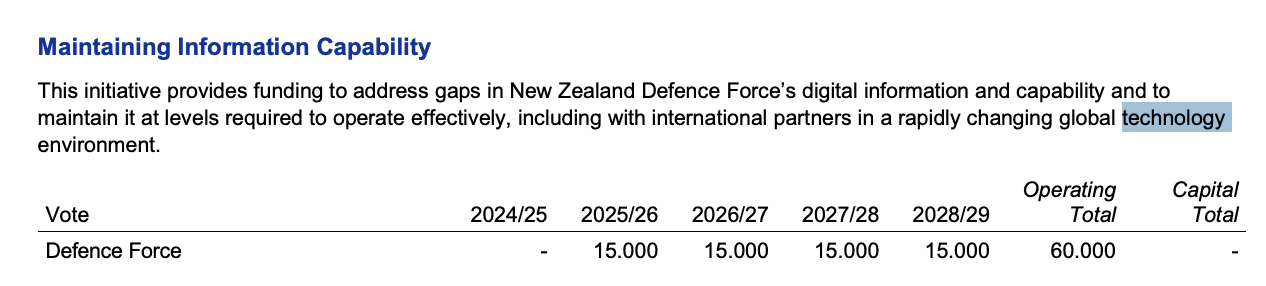

Well foreshadowed before Budget day was the Defence Capability Plan featuring $12 billion in funding, $9 billion of it new investment. Much of that will go into replacing marine helicopters, upgrading ships and hiring more people. $60 million will go towards bringing digital and information systems up to standard to maintain capability and interoperability with global partners.

There’s also money in the plan for IT-related spending, but we don’t know how much because the amount has been redacted due to it being commercially sensitive. A big chunk of money will go towards an enterprise resource planning software upgrade for NZDF.

Slim pickings elsewhere

A few other tidbits - in the education space, a “Virtual Learning Network to address teacher supply challenges for wharekura and secondary schools in science, technology, engineering, and mathematics” will be established. And then there’s $8.2 million for the SaaS system that will see over half a million children tested on a regular basis to check their proficiency in reading, writing, and maths.

In health, 24/7 access to digital primary care for online medical consultations will receive funding, “making it easier for people to get advice and prescriptions from their own homes”.