Griffin on Tech: Building an UpStart Nation, ComCom’s long overdue payments probe

I was in a rush to make it home for a Zoom call earlier this week so jumped in a Combined cab for the first time in years.

It was a move I soon regretted. The 7-minute ride from The Terrace in Wellington to Oriental Terrace cost $25.80, but when I produced my credit card to pay for it, a $4 fee was added on, taking the total to $29.80.

The driver shrugged when he heard my gasp of shock. “Sorry, we’ve no control over it,” he said sheepishly. It’s back to Uber for me. But the lack of options and high cost of in-person payment transactions has finally caught the attention of the Commerce Commission.

This week it said it was “looking at ways to remove barriers to more innovative payment options that would allow Kiwis to make in-person payments directly between bank accounts, as a low-cost alternative to current card payment options”.

Over the last 25 years we have morphed from the bulk of people using the cheap and rock-solid Eftpos network to pay for things, to the credit cards scooping up more of the transaction volume, and charging transaction fees in the process.

The superapp revolution

Other countries like China, with its WeChat super app, and its equivalent Grab which is available throughout South East Asia, allow consumers to make real-time bank-to-bank transactions simply by scanning a QR code.

The big banks cosy relationship with the credit card companies, and their control of the payments infrastructure in New Zealand, is stifling innovation, and costing us a fortune in fees.

“We’ve observed a lack of innovation in options to enable Kiwis to pay for goods and services via in-person bank transfers and have identified a way for the Commission to help enable better outcomes,” Commerce Commission Chair, Dr John Small said this week.

“Bank transfers are typically one of the lowest cost payment options and if it were safe and easy for Kiwis to pay this way in-person, merchants would benefit from faster, cheaper payments,” he added.

What the ComCom is eyeing is making the bank transfer network a designated service, meaning it could require banks to open up access to new players. That could dovetail quite nicely with the new Consumer Data Right, enabling innovation in the fintech space and new options for quick and cheap payments.

It’s early days in resolving this issue, but a discussion paper from the ComCom sets out the issues and any entrepreneur or tech company involved in electronic payments needs to have a say on it.

UpStart Nation?

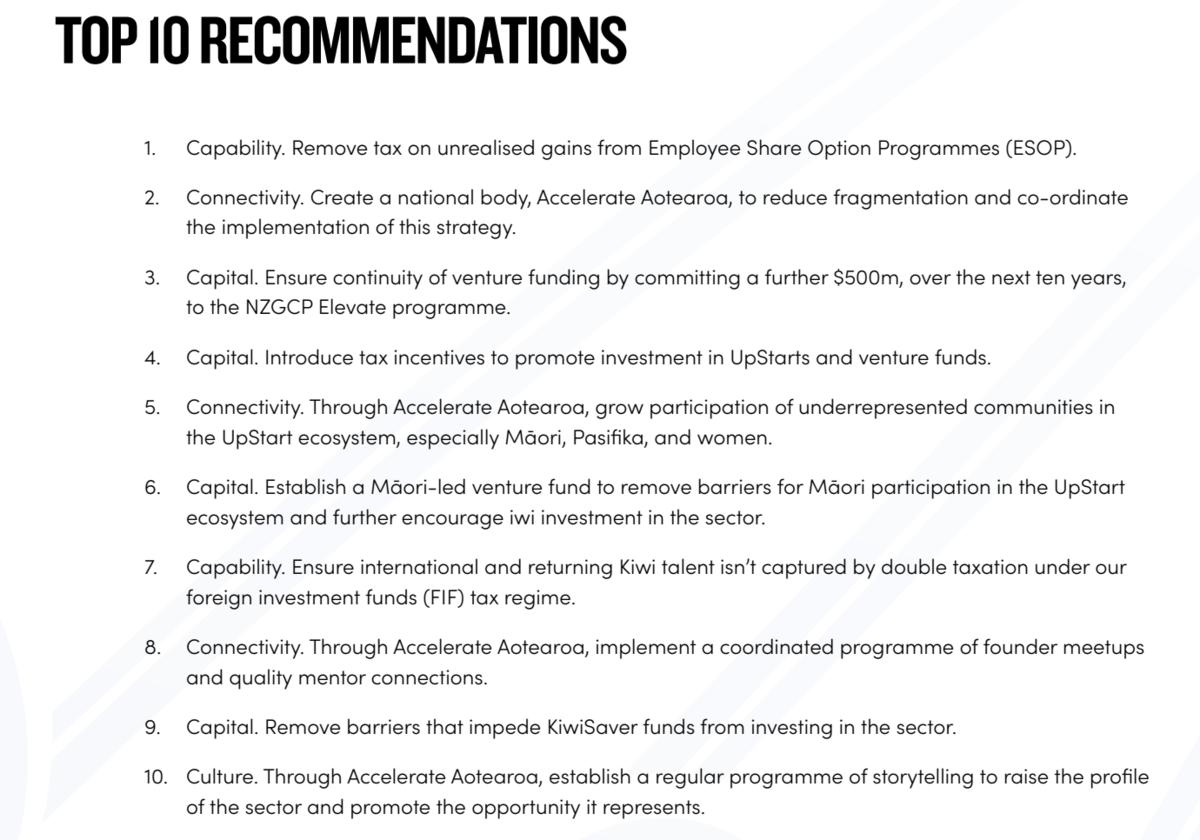

The Startup Advisors Council has released its long-awaited report on how to take our startup sector to the next level and has even come up with a provocative brand for it - UpStart Nation.

It’s a play on Israel’s Startup Nation and implies we need to take a more disruptive approach. But are we capable of it, and do the Council’s recommendations map the way forward towards achieving it?

There’s a lot to like in the report, including tangible goals to grow the number of startups, government investment in funding early-stage companies, and having more people working in the startup ecosystem. But the feedback I’ve had this week from people around the tech sector is that we’ve some wider structural issues in education and the skills pipeline, our research sector, and capital markets that need addressing to unlock the potential outlined in the report.

For instance, the goal of having “75 startups spun out of public research organisations per year” by 2030 is laudable, but our Crown research institutes are a long way from being able to deliver that. Likewise, the goal of having “5,000 active high-growth startups” by 2030, more than twice the current number is ambitious.

But there’s no point having many more startups if they haven’t got the right ingredients - innovative technology, talent, and capital, that will allow them to scale up and become sustainable businesses.

The report seems to have been received favourably by the political parties, who will no doubt cherrypick aspects of it that are politically palatable and don’t cost a bomb. But the actions really need to integrate with the revamp of the research sector currently underway, as well as efforts to open up our domestic skills pipeline. Without a cohesive approach, we risk leaving our new cohort of upstarts high and dry.

Source: Startup Advisors Council report