Griffin on Tech: The tide is (slowly) turning on R&D spending

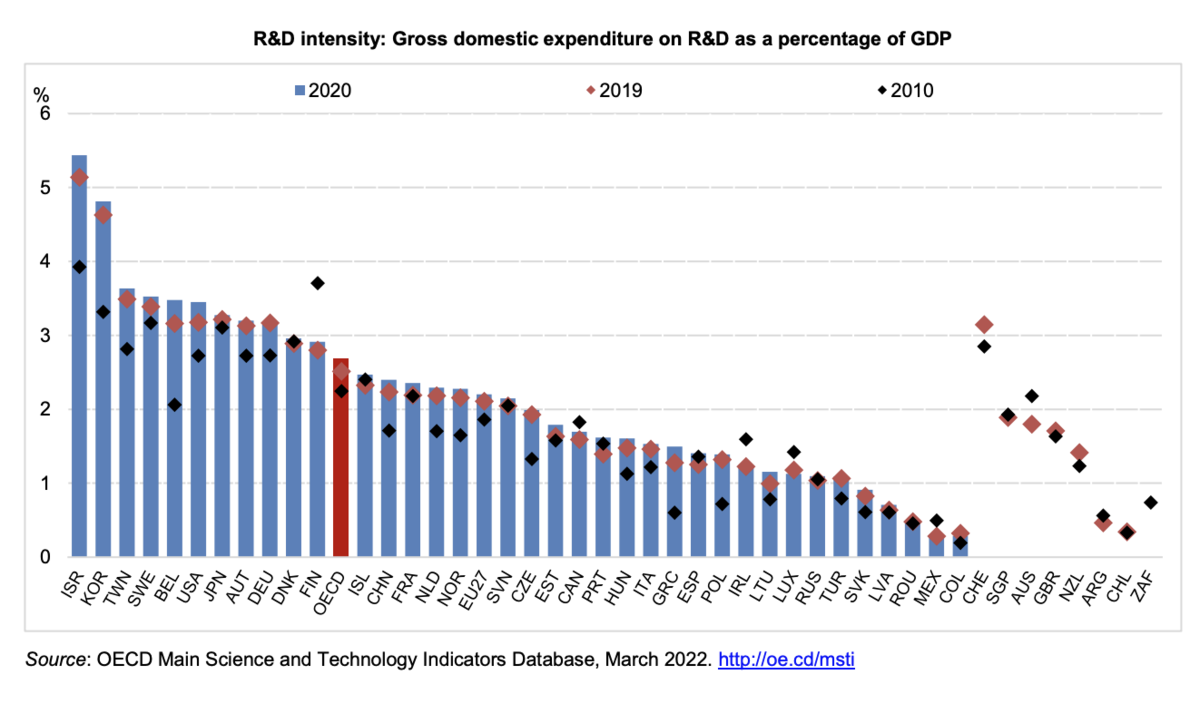

When you look around the world, most advanced economies that we like to compare ourselves to spend at least 2.5% of their gross domestic product (GDP) on research and development. Israel and South Korea spend nearly 5% and both have flourishing tech sectors.

There’s a sound reason for businesses and the government to spend billions of dollars each year doing so - R&D creates new knowledge that can be translated into novel products and services that help boost the economy.

So this week’s news from the Government that business R&D increased by around $1 billion in the last nine months very welcome indeed. The Government’s Research and Development Tax Incentive has driven the spending.

Since its introduction in the 2019/2020 tax year, the 15% tax incentive scheme has paid $312 million in tax credits. That means around $2 billion in eligible R&D spending has been undertaken.

The R&D tax incentive scheme had a slow start. It arrived as Covid-19 descended on us and many businesses were in survival mode rather than focusing on R&D. The system was initially confusing, and too difficult to navigate

There was also frustration in the IT sector and among software development companies in particular, that many aspects of R&D it was engaged in didn’t qualify for the tax incentive. The Government was too narrowly defining what constituted R&D.

An R&D incentive rethink

The scheme was at risk of failure, so in 2021, changes were made.

“In a very welcome move, the Government has released updated R&D activity eligibility guidance to bring the bar to qualify back down to the original policy intention, which was to cover scientific research all the way to experimental application of existing technologies and techniques to seek new or improved outcomes,” EY pointed out at the time.

The bar was lowered and the system was made easier to navigate. As a result, we’ve seen a flurry of applications for the tax incentive.

“To make the scheme more accessible and attractive, we began in-year payments to allow businesses to receive regular payments throughout the year, rather than having to wait for the money to be paid out after the end of the tax year,” research, science and innovation minister Dr Ayesha Verrall said this week.

“The addition of in-year payments is a world first and enables small businesses and start-ups to better manage their cashflow.”

A long way to go

As a result, we are now sitting at 1.47% of GDP spent on R&D. If the trend in spending continues, we’ll be on track to meet the Government’s goal of annually spending 2% on GDP, a target that has so far eluded us.

But other countries are not standing still on their R&D investment. The latest data from the OECD suggests that member nations spent an average of 2.7% of GDP on R&D in 2020. Part of that is down to the fact that GDP declined in most countries in 2020 while R&D slightly increased. But the fact remains that at barey 1.5% of GDP spend on R&D, we are underspending in this area compared to most other countries.

That has implications for our ability to remain competitive and to unlock the potential of research underway in our public and private laboratories.