How SaaS start-ups are doing in the midst of the economic downturn

New Zealand software as a service (SaaS) startups have experienced great export success, but how are inflation and soft economic conditions impacting the SaaS market in general?

After all, subscription-based services paid monthly or annually are vulnerable to being cut at the behest of cost-conscious management looking to tighten the belt in hard times. There’s certainly been a lot of that in the SaaS market leading to slower growth for these companies. But a new study suggests the industry may be seeing light at the end of the tunnel.

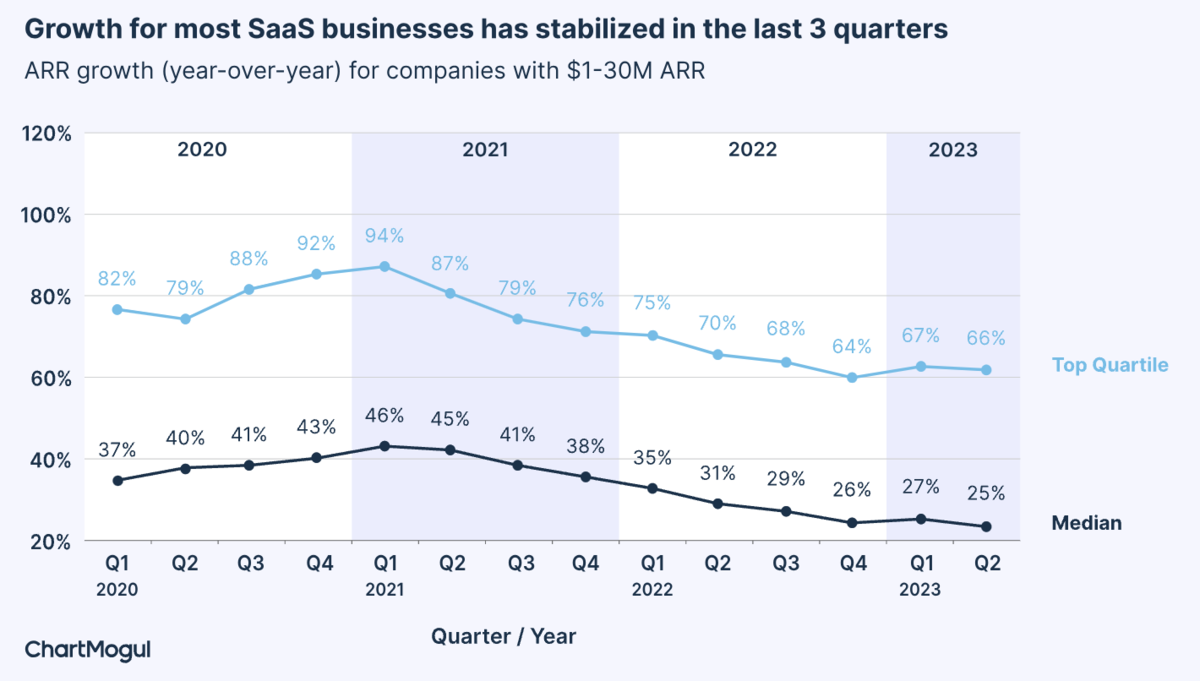

The inaugural SaaS Growth Report, published by ChartMogul, a subscription analytics platform used by software startups around the world, found that growth is stabilising for most SaaS businesses.

“Year-over-year growth rates for the top quartile of SaaS companies with US$1-30M annual recurring revenue (ARR) have stabilised in the last three quarters. While the data doesn’t show any gain, it’s clear that growth is not deteriorating,” ChartMogul reports.

Source: ChartMogul

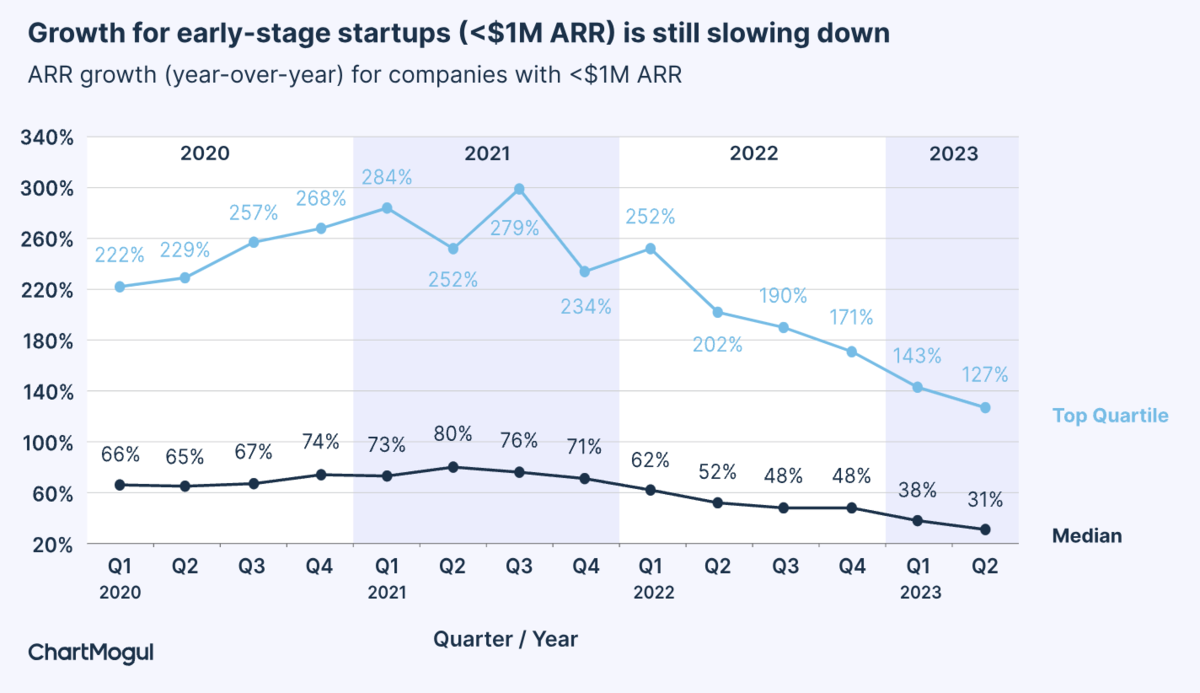

For early-stage startups, growth rates peaked in 2021, and have more than halved since then.

“The slowdown is broad-based. It’s a tough market for companies just starting out,” the ChartMogul study suggests.

While the annual growth rates of 30 - 40% seem spectacular, they are well down from the 60 - 80% media growth SaaS companies were enjoying two years ago as the pandemic pushed people to add subscription-based software to their toolset.

Early-stage SaaS companies are typically fast-growing, with a limited amount of funding to get them to a point where they can sustain themselves with recurring subscription revenue.

Source: ChartMogul

It’s not surprising that retaining customers is proving more challenging in 2023 than in the previous couple of years.

“With the crisis persisting, SaaS businesses challenge their tech stack more often. This results in lower overall retention. This drop is very visible at seed stage where companies now need to be frugal in order to reach their Series A,” Enzo Avigo, CEO & Co-founder at June.so, told ChartMogul.

“It is also significant for mature businesses that decide to build tools internally in order to save some cash which costs a lot these days,” he added.

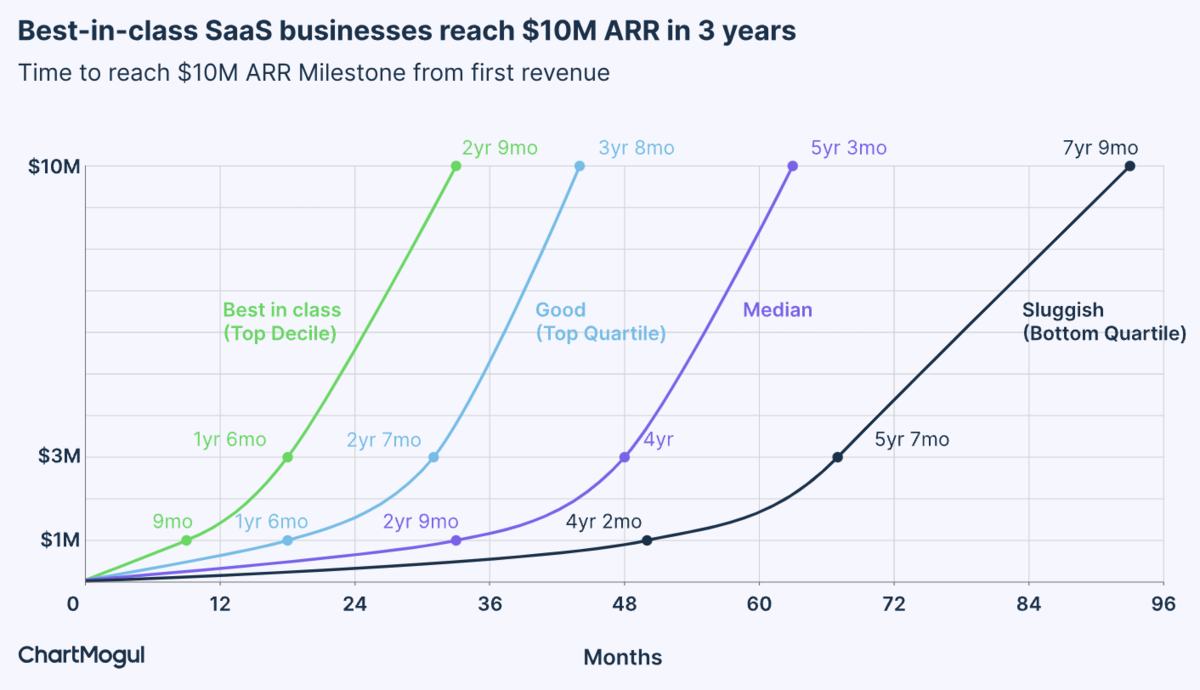

And for those in the SaaS space looking wistfully to a time when you are out of the woods, with solid revenue, and even a lucrative exit on the horizon, this graph will put things in perspective.

Source: ChartMogul

ChartMogul’s study featured data from 2,200 SaaS startups and covered the 12 months to June 30, 2023.

Some other highlights from the report:

- SaaS growth rates have stabilized in the last 3 quarters. While the data doesn’t show any gain, it’s clear that growth is not deteriorating. There are pockets of optimism. Growth for best-in-class SaaS startups is accelerating and new business activity is picking up.

- Best-in-class SaaS businesses grow over 100% each year. The top decile of SaaS businesses with annual recurring revenue (ARR) in the range of US$1-3M grow at 192% annually. Those in the $3-8M ARR segment, grow at 121%. And those, in the $8-15M ARR segment grow at 110%.

- Top-tier SaaS startups reach $1M ARR within 9 months. The median startup takes approximately 2 years and 9 months. On average, SaaS startups reach $10M ARR in slightly over 5 years. Even after 10 years in business, only 13% of SaaS startups are able to hit the $10M ARR mark.

- The majority of SaaS startups grow from $1M to $10M ARR by growing their subscriber base. Only a small subset (<5%) of startups grow predominantly by increasing their ARPA.

- SaaS is mildly seasonal. Q1 is usually the best quarter of growth, and Q4 is the slowest. March is the best month and July and December are usually slower (due to holidays).