Small business worried about AI developments outpacing regulation

Accounting software company Xero used its Xerocon conference in Sydney this week to showcase AI-powered predictions in bank reconciliation and generative AI pilots to improve customer service.

But a global survey of 3,000 small business owners by Xero also shows its own customers are nervous about the pace of advances in AI, particularly with the prospect of generative AI becoming a tool central to accounting functions.

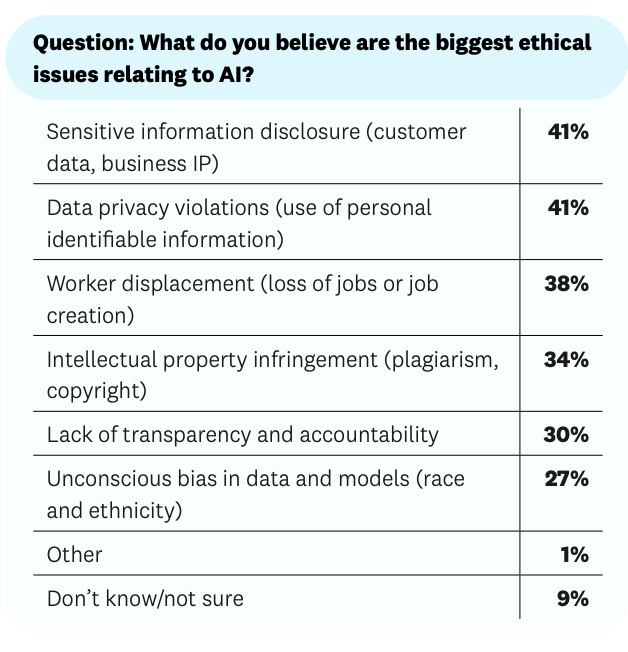

Of the businesses surveyed, 78% reported being “concerned AI development and adoption is outpacing regulation”. The biggest areas of concern were around disclosure of sensitive information (51%) and privacy violations (50%). Worker displacement was also flagged as an issue with 44% considering it the biggest ethical challenge around AI.

“While AI brings lots of benefits, the survey results highlight the need to provide more knowledge, tools, and policies to ensure small businesses are not left behind and can continue to thrive,” says Mark Rees, Chief Technology Officer at Xero.

“Xero’s always looking at how we can bring new technology safely into the hands of customers, in a way that will make a positive difference in their lives. It’s about putting the customer first; not shipping lots of AI features for the sake of it.”

Xero has published an AI guide for bookkeepers looking to employ the technology via Xero’s tools and third party platforms.

Source: Xero

Xero user Bluerock, a Melbourne-based entrepreneurial advisory firm, is looking at how to apply an extensive knowledge base of advice letters and tax rulings an AI model.

“So when a consultant asks a question, the tool will give the right response, as it’s deferring to our own content,” says David Hanus, Bluerock’s chief information officer.

We’re now integrating it into our advisor workflows, such as summarising documents, drafting letters and formatting emails. It will significantly reduce the manual writing time,

but ultimately our advisors are still providing their IP and expertise into that output. GPT is just applying that expertise faster.”

Despite the buzz around generative AI, many small businesses appear to be sitting on the sidelines for the timebeing. Of those surveyed 32% weren’t taking any proactive steps to introduce AI, while a further 32% were “experimenting”, with 21% investing in new tools.

While many businesses are concerned at the pace of development in the area of AI, they appear to be feeding sensitive data into AI applications. More than half (51%) of survey respondents say

However, the survey shows many small businesses trust AI tools with sensitive data, they trust AI with identifiable customer information, while 45% trust AI with their sensitive commercial information.

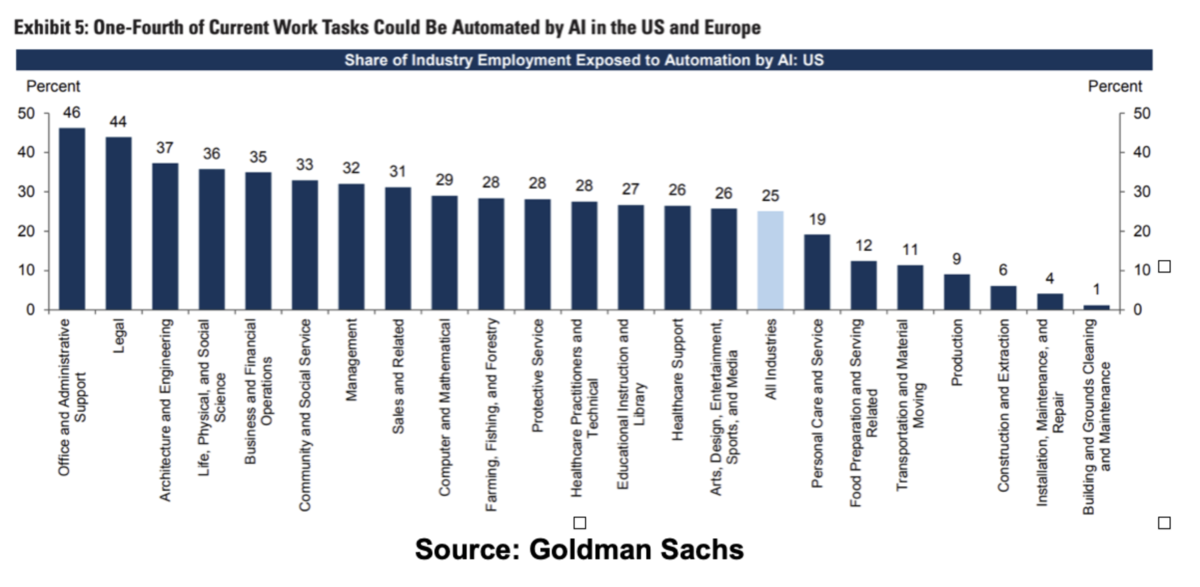

Investment firm Goldman Sachs estimated earlier in the year that 25% of jobs across Europe and the US are set to be disrupted by the new wave of generative AI applications based on large language models. White-collar jobs will be most impacted.

Goldman Sachs estimated that 35% of business and financial operations could be automated by AI, with 44% of legal services and 46% of office and AI services set to be taken over by artificial intelligence.

About the Xero research methodology

The research was commissioned by Xero and conducted by Lonergan Research in accordance with the ISO 20252 standard. Lonergan Research surveyed 3,051 business leaders in organisations with 50 or less employees. Surveys were distributed throughout Australia, New Zealand, Singapore, UK, USA and Canada, with at least 500 participants per market. The survey was conducted online amongst members of a permission-based panel, between 8 June 2023 and 21 June 2023. After interviewing, data was weighted to the latest population estimates sourced from the Australian Bureau of Statistics.